🔥 Introducing the Ultimate Credit Transformation Toolkit! Unlock Your Financial Freedom Today! 🔥

Are credit issues holding you back?

Limited Time Offer: Was $697, Now Only $97!

🔥 Introducing the Ultimate Credit Transformation Toolkit! Unlock Your Financial Freedom Today! 🔥

Are credit issues holding you back? Say goodbye to financial frustration and embrace a brighter future with our comprehensive credit solution. Get ready to experience financial liberation like never before.

Limited Time Offer: Was $697, Now Only $97!

🌟 Product Benefits: 🌟

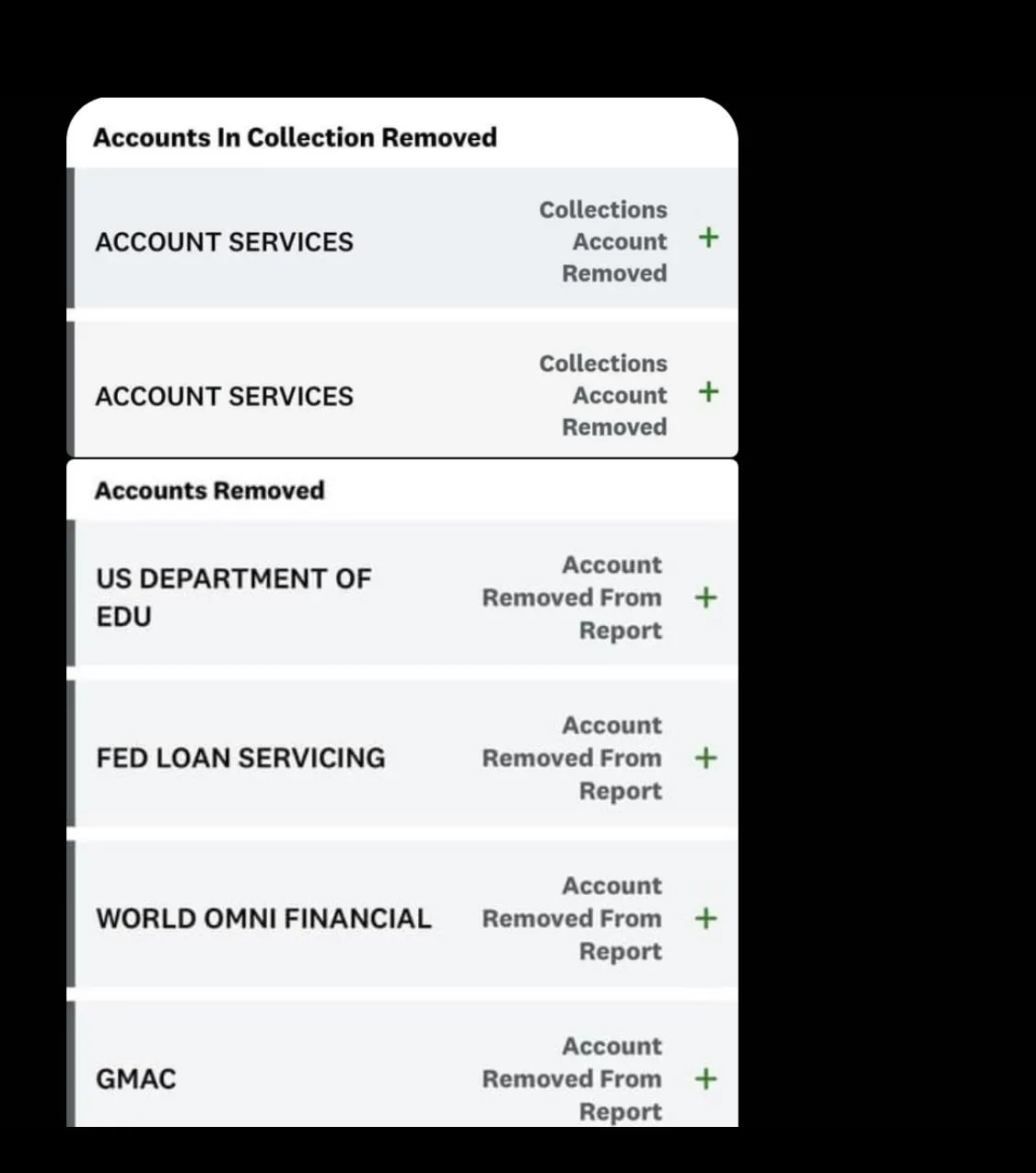

🚀 Credit Accounts Overhaul: Get control over all your credit accounts, even those with high utilization.

⏳ Lightning-Fast Late Payment Removal: Eliminate those late payments in just 2 days.

🌐 Unlock the Power of Your Credit: 🌐

✨ Fast-track Credit Improvement: Speed up your credit journey like never before.

💡 No Fluff, Just Results: We cut through the noise, focusing on consumer law and USC Codes.

📝 Action-Packed Credit Process: Step into a world of efficient credit restoration.

📞 Direct Bureau Communication: Speak directly to the credit bureaus, no intermediaries.

💌 Proven Letters with Guaranteed Results: 💌

Our meticulously crafted letters are armed with the proven 605b, consumer law, and USC codes that ensure the removal of nagging accounts in a mere 3-14 days! Say hello to the fresh start you deserve!

🚀 Don't Wait Any Longer – Act Now! Your Financial Liberation Awaits! 🚀

Meet Your Coach.

Meet Ashley, the fearless Globalprenear & Financial Literacy Coach hailing from Houston, TX!

She's on a mission to kick procrastination and fear to the curb, helping YOU dominate this decade and achieve your wildest dreams. Ashley's a force to be reckoned with!

With over 17 years of financial industry expertise, Ashley's a master at unleashing the power of credit to set you on the path to financial freedom.

Whether it's owning a home, starting a business, or taking control of your personal credit, Ashley has guided countless individuals towards their goals. She's not just about talking the talk; she walks the walk! 🚶♀️

But wait, there's more! Ashley's not only a financial guru; she's a boss in the business world. She's got her own perfume line, Luvless Fragrance, multiple e-commerce stores, and even a sizzling food delivery app, ChewTyme!

17 years in the making, she's now a multi-7 figure powerhouse. Her ultimate goal? To inspire and teach YOU how to achieve the same incredible results in the 21st century!

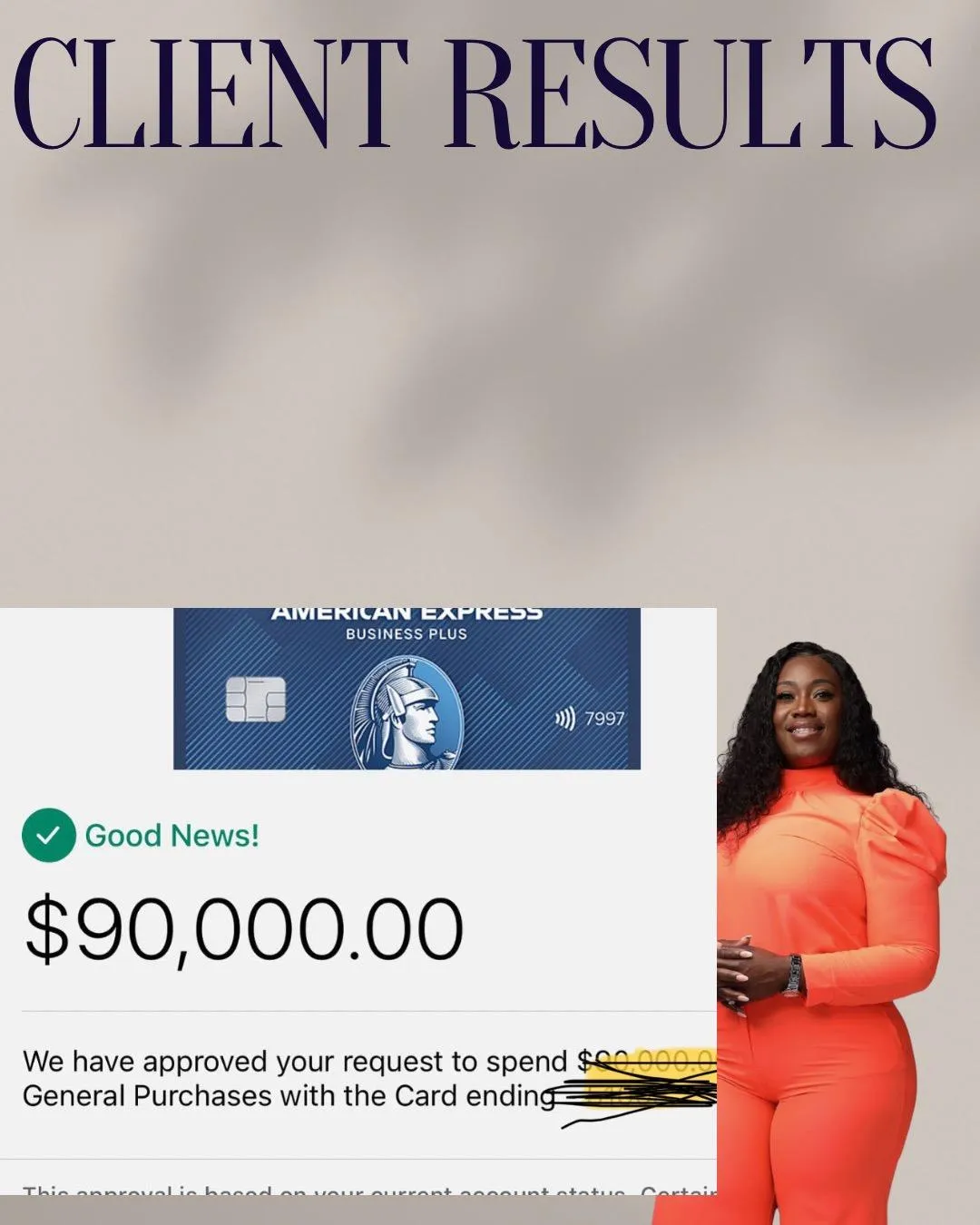

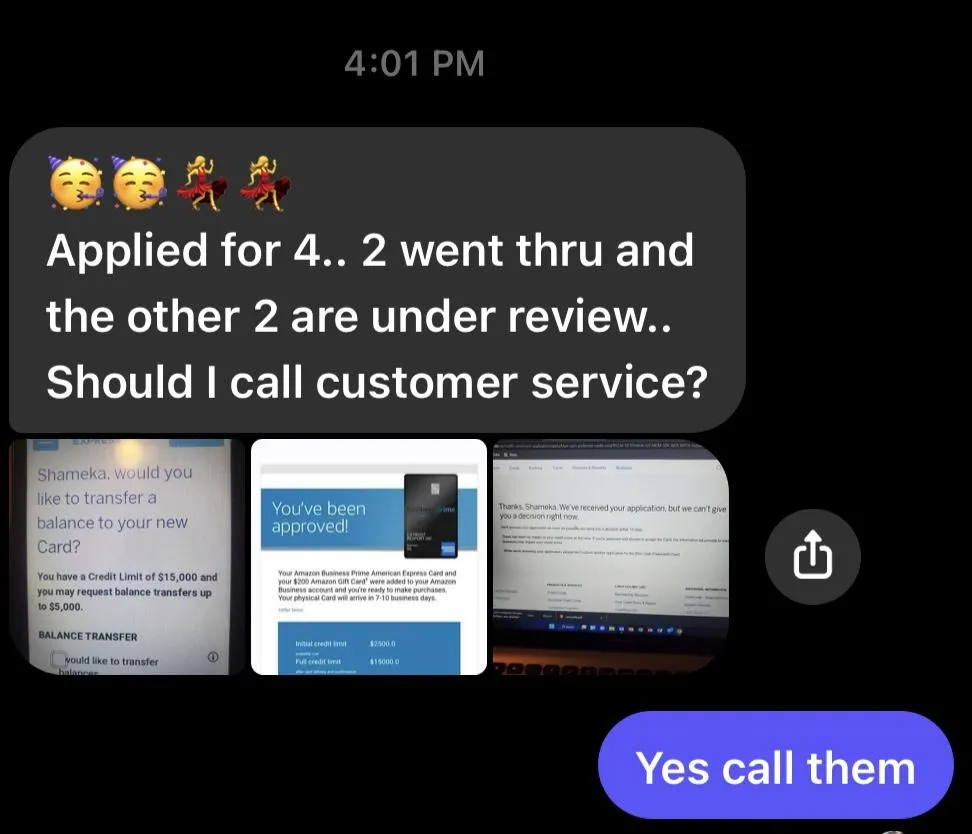

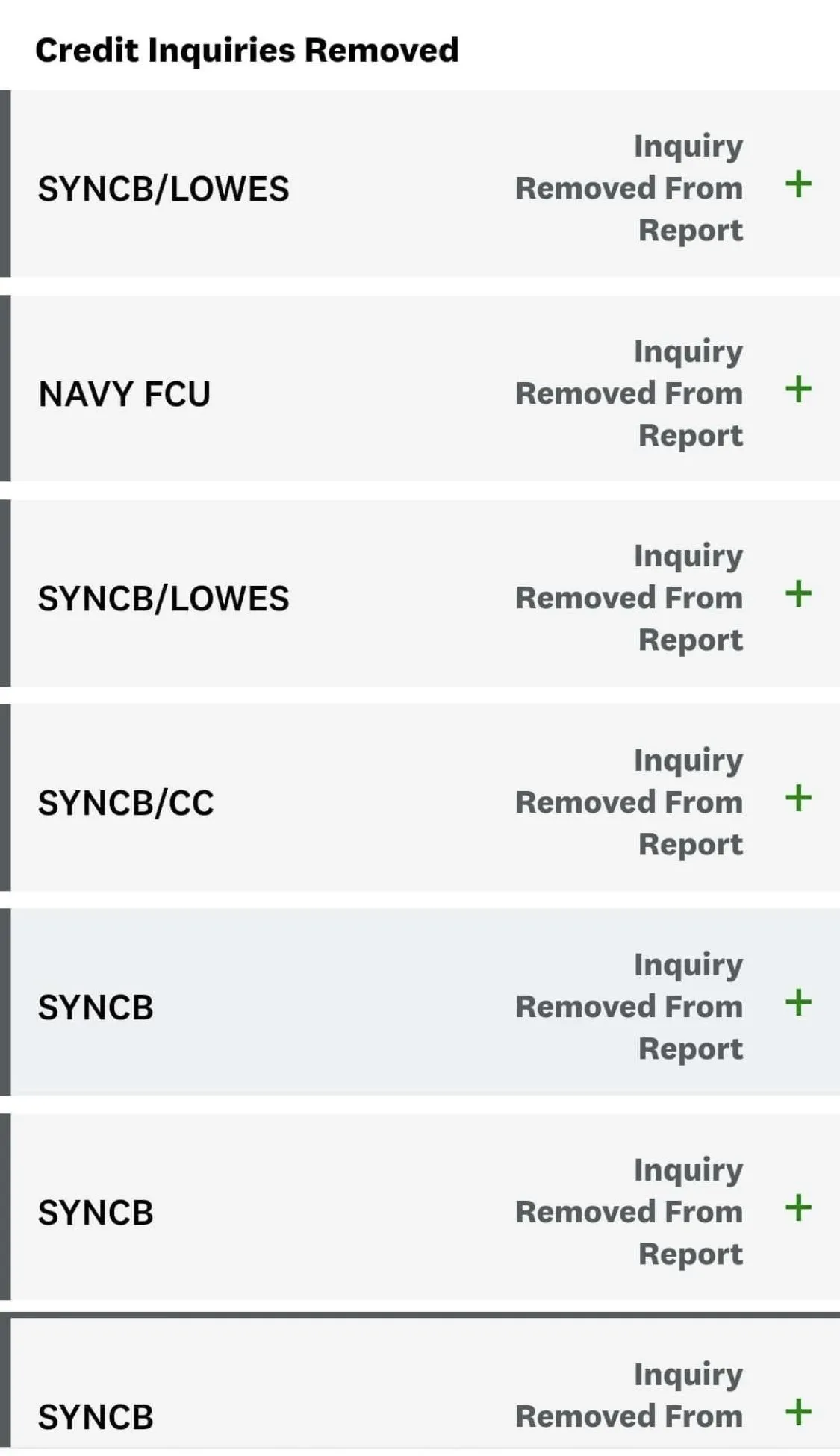

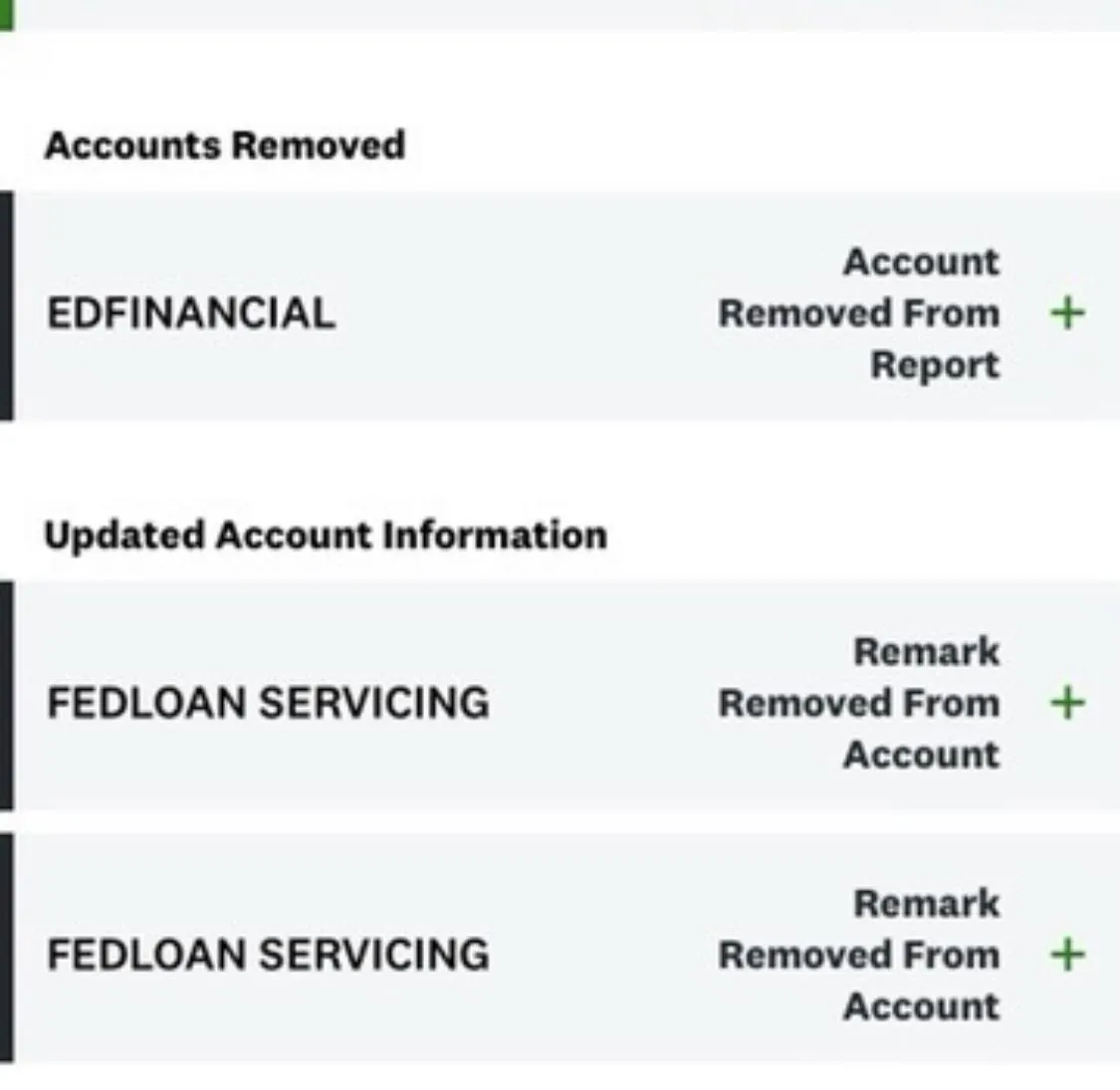

See What Our Happy Clients Have To Say....

See What People Are Saying About DIY Credit Repair eBook....

Get Instant Access To Everything You Need To Get Higher Credit Scores !

You Are Getting...

OUR BENEFITS

Product Benefits:

Credit Accounts - All, including open accounts (High utilization)

3-Day Collection Removal

Limited Time Offer: Was $697 , Now Only $97!

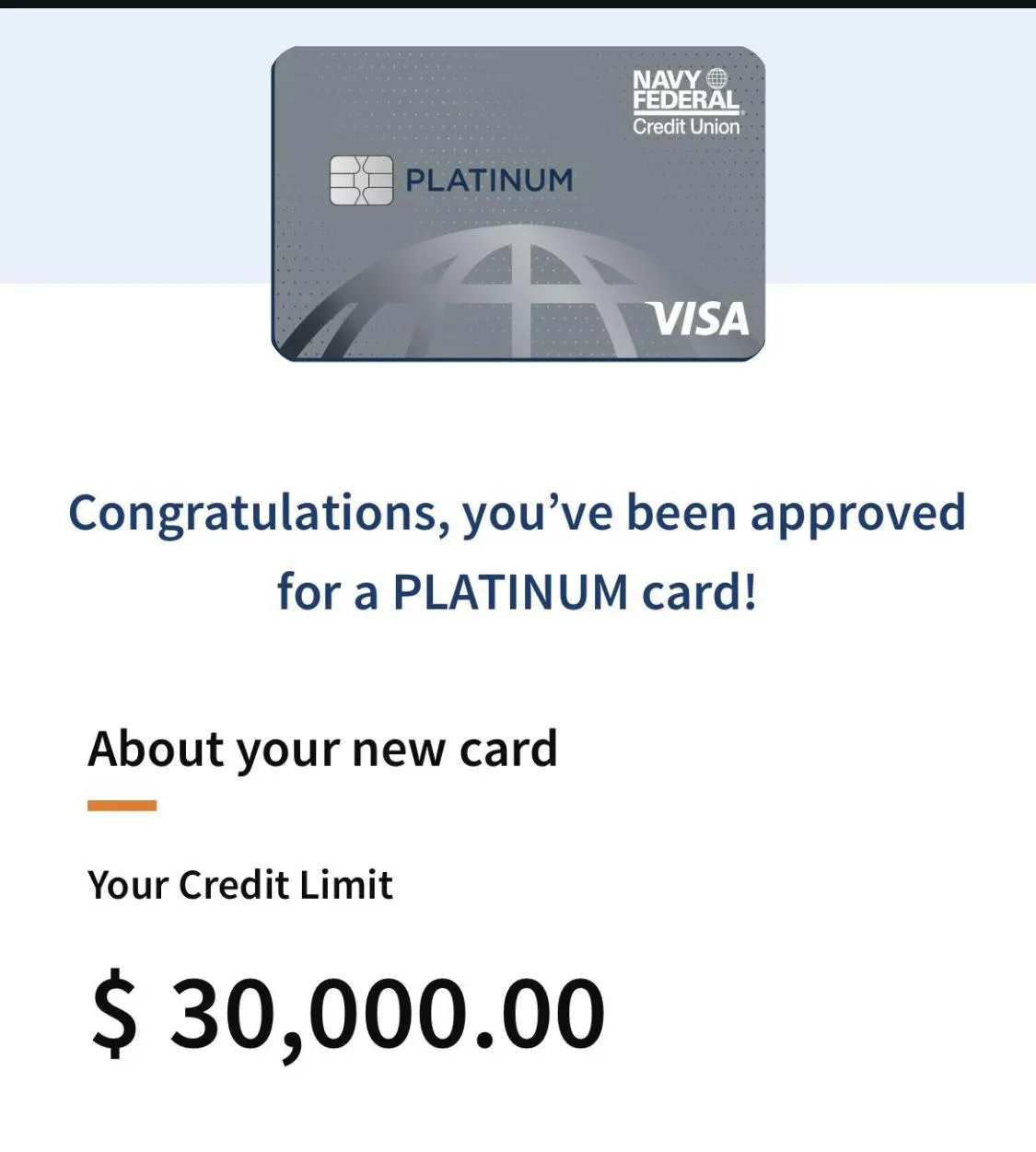

Unlock Ultimate Benefits With Better Credit Scores!

Reduced Interest Rates: Maintaining a favorable credit score enables banks and credit institutions to grant loans with diminished interest rates and increased borrowing limits, leading to significant savings for you.

Increased Approval Rates: People with positive credit histories are more likely to secure a loan or credit card compared to those with lower scores. By repairing your credit, your chances of qualifying for a loan will improve.

More Cost-Effective Insurance: When applying for auto and home insurance, insurance companies consider your credit reports. A favorable credit score increases the likelihood of qualifying for reduced insurance rates, allowing you to save money.

Financial Relaxation: Seizing the chance to attain financial freedom in your everyday existence, freeing yourself from concerns about money shortages, and relishing the moments of life.

Quicker Approval for Rentals: Prior to leasing an apartment or house, the landlord will review credit score reports. Maintaining a positive credit history increases the likelihood of successfully securing new rental agreements.